By Darryl McCullough

•

02 Jul, 2019

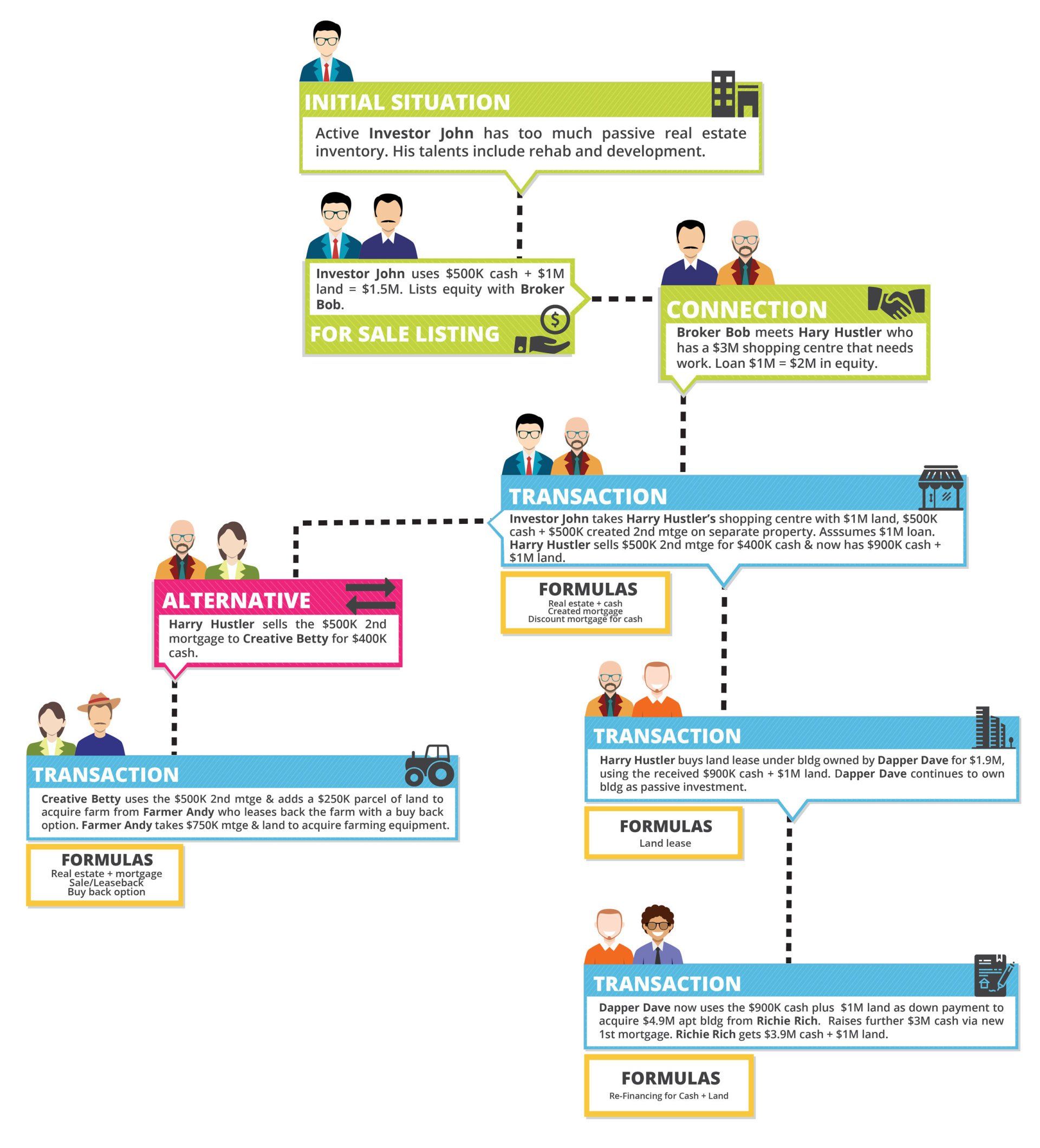

Warren Buffet once said: “I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in business. I read and think. So, I do more reading and thinking, and make fewer impulse decisions than most people in business.” Oh, how I wish those words and actions were undertaken in an earlier life when the onward daily addiction of deal making was the first and foremost consideration! Going forward, it will be my pleasure to share, on occasion, real estate investment and development books, articles etc., from authors I know and have dealt with, and/or have alternative respect for and trust in. The first shared offering is a manual authored by mentor Virgil Opfer and Dan Harrison, entitled “ 100 EQUITY MARKETING FORMULAS ”, which is always kept by my desk. Each formula has a one-page explanation that further opens up my mind to solution-based ideas using non cash equities to create Cash and Cash Flow, Partnerships, Down Payments, Financing, Leasing, Options, using created Mortgages/Notes to acquire, sell, structure, etc. etc.