EQUITY FUNDAMENTALS

Preparing For Increased Transaction Benefits

The below reflections come from years of both good times and, too often, attendance at the “School of Hard Knocks”. I found out that markets move up and down without my approval nor control.

Usually, the Hard Knocks education resulted from lack of attention to the following.

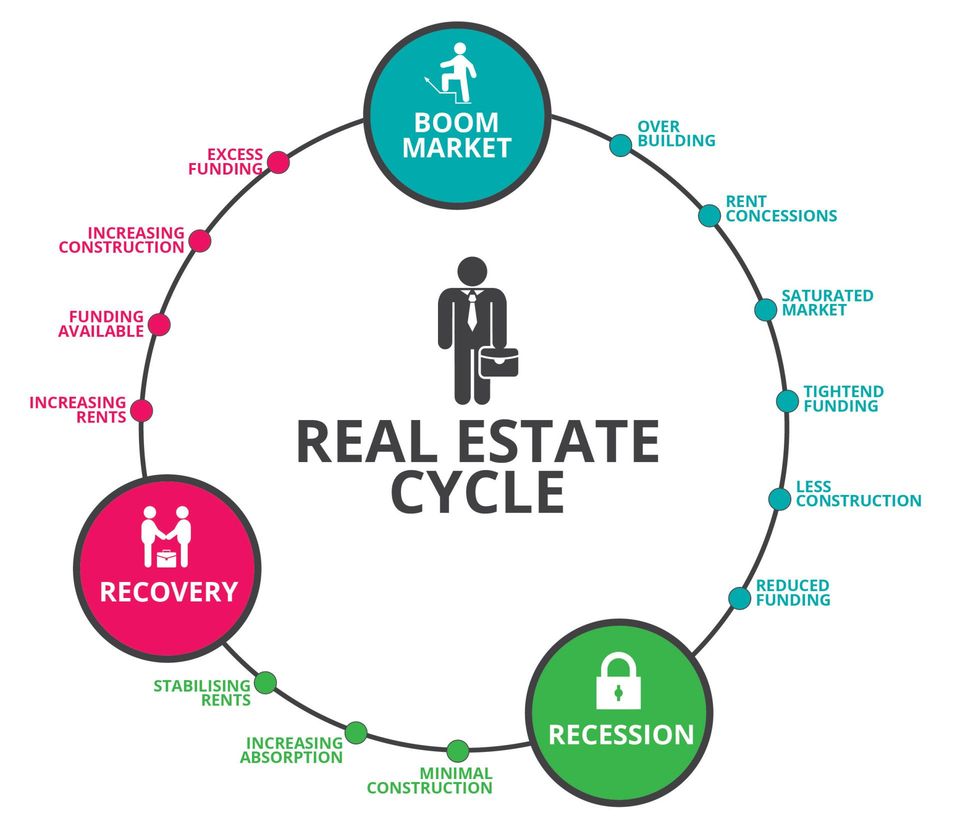

First of all, we must never forget that real estate investment is cyclical. Depending on your proforma time horizons, never assume real estate is always, every day, a good investment.

Always remember that recovery of your initial Equity investment is the most important thing to plan for.

Never assume that desired results will always work out. And that the investment will always be a winner!

In the buying and selling of property Equity, the development of real estate, the purchase of mortgages/notes, or any other investment or action we wish to take, there should be a clear planned result in mind regarding “Worse Case”, “Most Probable” and “Blue Sky” scenarios.

QUESTIONS TO ANSWER - MARKET

- If we own an equity to make a profit, what is our determination of profit?

- Is our profit horizon based on short term or long term?

- Will our profit objectives be before tax? After tax? Before closing costs?

- Is our future proforma profit predicated on re-sale(s), increased income, refinancing or a combination?

- Understanding the Real Estate Cycle. How often should we review those desired future results? Once a month? Once a year? Can our projections change? If the market changes for the worse, what just happened to our desired results? If the market improved, what just happened to our desired results? How do we monitor municipalities overall short and long-term objectives?

- How well do we keep informed about potential changes to zoning, official plans etc. resulting in change of use possibilities?

- Do we assume a market downturn will “NEVER HAPPEN HERE”?

QUESTIONS TO ANSWER - SPECIFIC EQUITY

- Why do we desire to move a particular equity including our real motivation?

- Are we Buyers with our Equity?

- What are our guidelines in using this Equity?

- What would we consider taking for our Equity?

- Is there a mandatory “Cash” component needed in the transaction? (i.e.: debt repayment)

- Have we really determined our objective?

- Do we understand “Benefits” beyond wanted cash?

- What benefits exist for someone to “Take” our Equity?

- Are we mentally committed to a fixed price or are we oriented towards increased benefits?

- What can we “Add” to our Equity to make a more attractive package?

- Have we explored the idea of being a user of a business opportunity?

- Will we instigate offers if it solves our immediate situation and leads towards long term objectives?

- Are we disposed to a possible Joint Venture with all or part of our Equity?

- Do we have any geographical limitations?

- Finally, are we realists? Do we understand “Takers” for our Equity need to assume a future profit potential also?

Solution Based Consulting

Consulting services are available upon request. Please contact us to learn more.