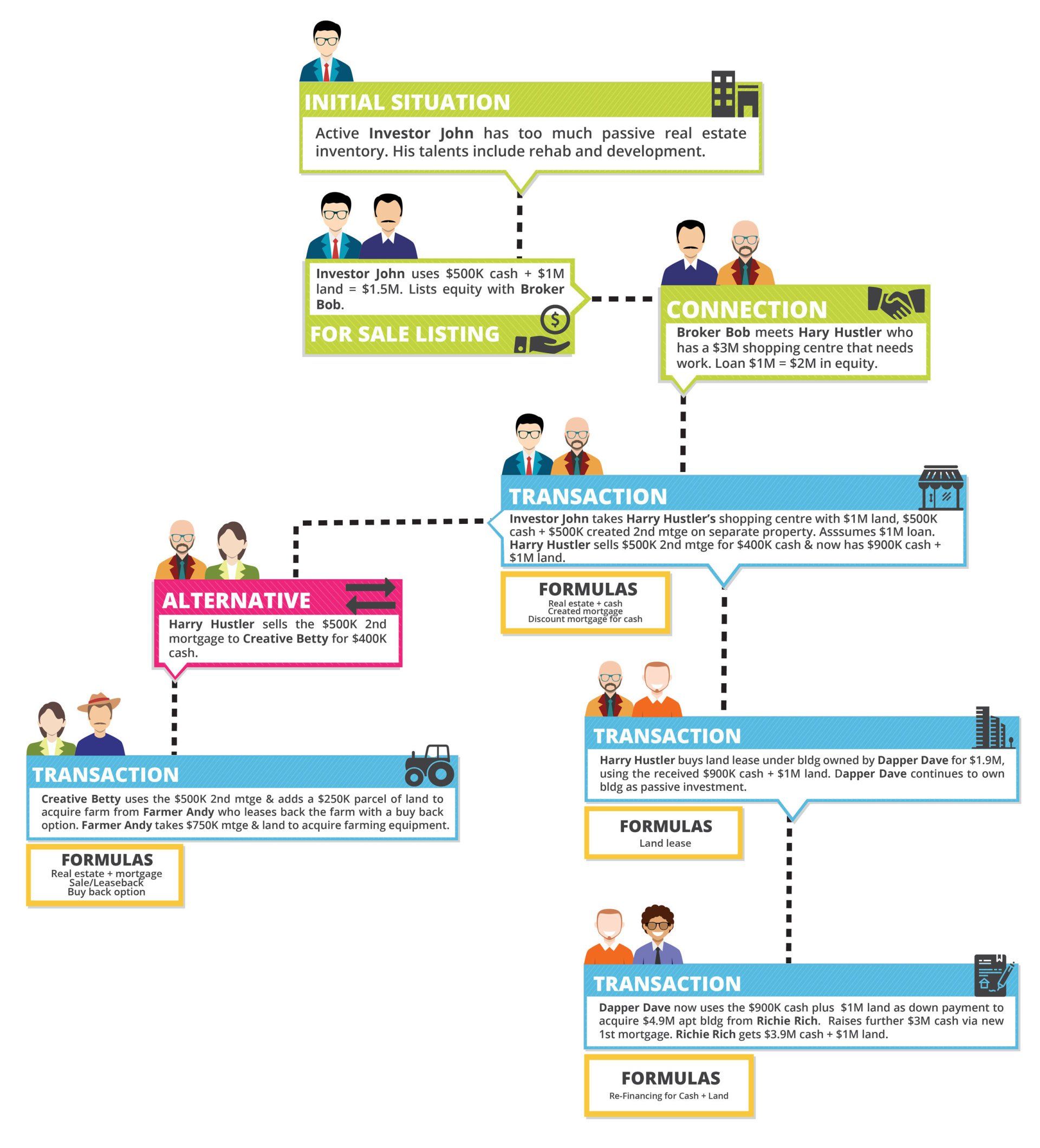

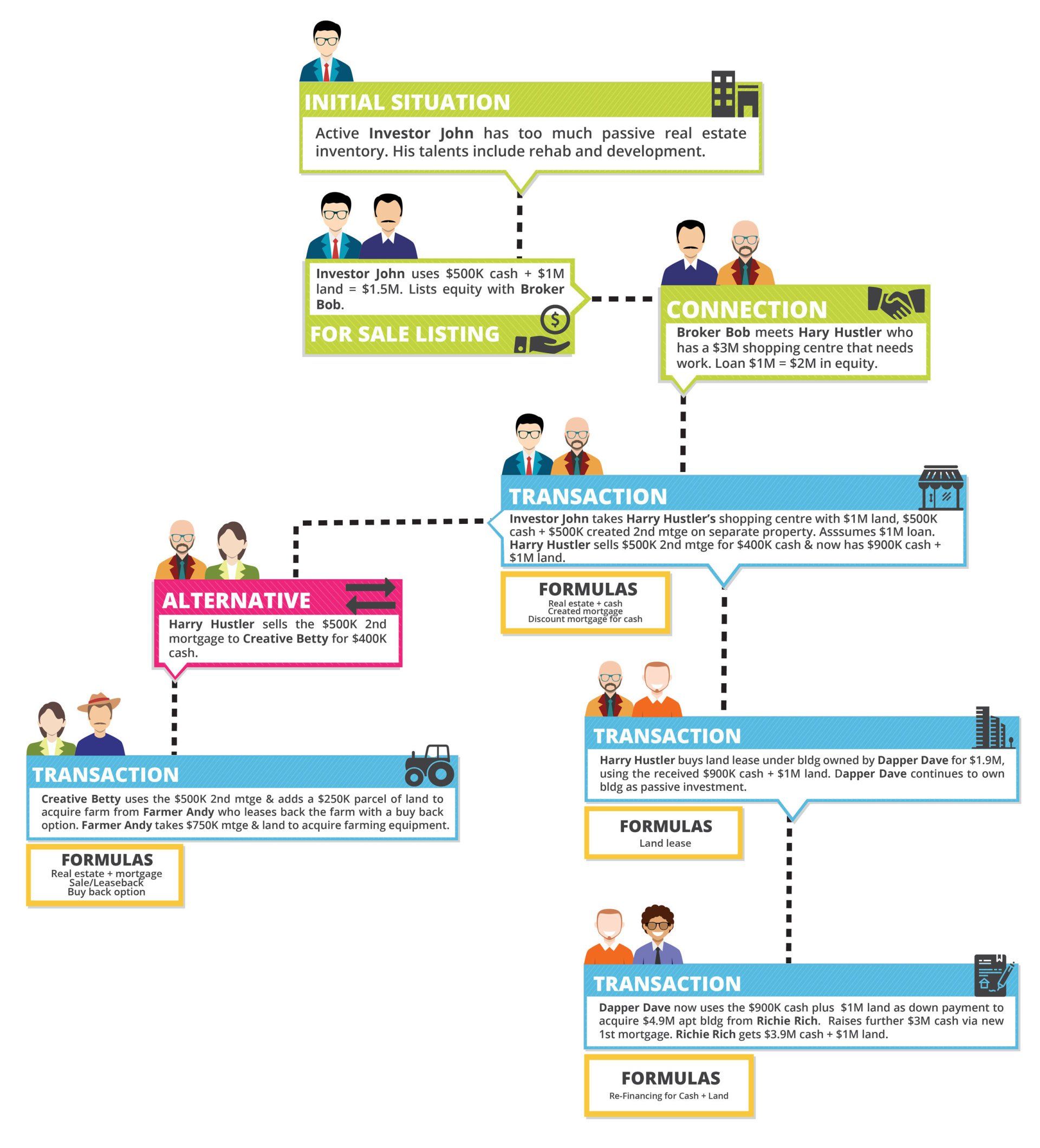

I remember a teaching moment during the 2008 recession that will forever be remembered.

It involved a partnership discussion regarding a slow-moving large land development I had brought money to. My friend and long-term Managing Partner was Bill Stonaker who was apologizing for the slow movement in selling off pad sites, creating build-to-suits etc. that entailed this particular business plan.

The Investor Partner quickly intervened with the following wisdom.

Saying that, the Investor Partner noted the number one reason for initially investing was because of Bill’s personal integrity, which was just as important as his well-known amortized development knowledge. Cash call assistance was then quickly offered out for any current or future perceived shortfalls needed at that particular point in time. No further questions asked!

And, the project has ultimately proven to be an absolute "HOME RUN" for all investor partners.

We have been involved with many “Safety First” Partnership structures over the years, and can share further input if desired.

However, first of all, to answer this basic question, perhaps there exists further direction and answers through visiting the article on our web site entitled “We are All Different”.

In addition, consider this list of things to consider either as a Managing Partner or more passive Investor Partner, when thinking of becoming involved or continuing a Partnership.

In the end, observing the above should help render a solid profitable investment.