One of the true rewards of business travel outside our local geographical markets to attend meetings, marketing sessions, and symposiums is that we get a chance to reach out, meet and build relationships with like minded entrepreneurs ready to share their ideas, life experiences, and values. One extraordinary mentor to many of us is a long-time associate, Virgil Opfer. He has been a catalyst in sharing concepts and ideas that we all have readily been able to use back in our individual home markets.

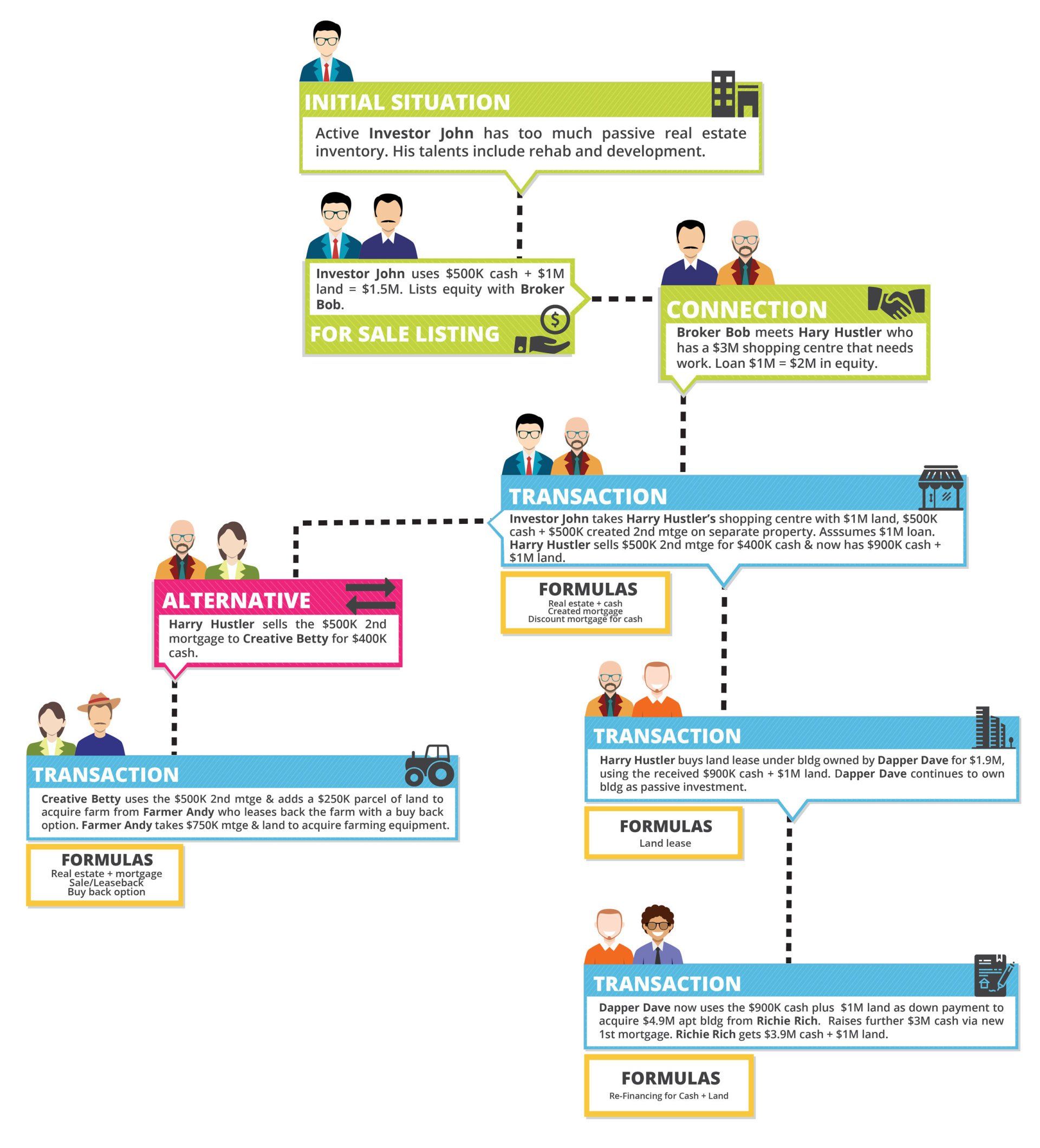

In upcoming articles, Virgil has graciously allowed me to share his knowledge on topics such as extended land development ideas, as well as a wonderful book he wrote outlining 100 Equity Marketing Formulas.

Last month our article ventured into “Partnerships”. This month, Virgil has agreed to allow me to extend the Partnership dialogue by offering an article he wrote regarding a partnership structure that will surely activate creative minds and bring together complimentary skill sets. It is presented below, as written by Virgil, except for some very minor tweaking. I trust this article will be a benefit to the reader.

__________________________________

There are many ways to form a partnership, but over time, most profit-sharing methods in partnerships don’t work. This article addresses a way that does work.

The traditional share-and share-alike agreement seems like a fair arrangement at the beginning of every partnership. Does this sound familiar, “We will both share the effort and split the profits “50/50”. Even with the best of intensions, somehow, over time, the equal sharing of effort, time, and risk seems to fade away and the partners are no longer participating on an equal basis. Inevitably, one partner ends up pulling more than half of the weight. However, under their partnership agreement, both partners continue to share equally in the profits. In our opinion, this share-and share-alike agreement is a sure-fire formula for a partnership to fail.

A few years ago, five brokers, who knew each other for many years from their monthly local exchange meetings, got together to see if they could make some money and have some fun doing it. The five brokers, Chet Allen, S.E.C., Dan Harrison, Greg La Marca, Virgil Opfer, S.E.C., and Bob Stewart decided to join together to seek exceptional real estate opportunities.

This decision led to a series of organizational meetings. At the early meetings, we decided to define in writing our goals and objectives. The impetus for that important decision was the direct result of the Business Symposiums, sponsored by S.E.C. and in particular, the Denver symposium at which Harry Kennerk, S.E.C., clearly defined the importance of setting specific goals, and to define the obstacles in achieving those objectives.

At one of the early meetings, Chet Allen brought a unique idea to the group that really set our team into high gear. Chet’s concept (a genius inspiration, in my opinion) was that we dissect a typical transaction into some very basic functions, then, as a group, agree on a value for each of those functions, or roles, in order to provide a financial incentive for each of us to seek out those functions and receive the associated reward for doing so. Chet went on to suggest that after the persons have been rewarded for their specific roles, that the remaining profits (if any) would then be divided based on the traditional share-and-share-alike arrangement. That way, those who performed the most important functions in any given project would be paid first and in greater measure than those who contributed in a more minor role to the success of the project.

The idea led to several lengthy meetings with round after round of lively discussion. The basic thought behind the reward system was simple, “Let’s make the reward for each role first based on logic, but also make the reward so attractive that each of us will want to play each role”. Each project would stand on its own, with a separate written profit-sharing agreement for each new project. Once the sharing arrangement was set, it would remain unchanged for the duration of that particular project, even if subsequent events led to changes in future financial structures.

It was at this time we also decided to incorporate and the company, G5 Enterprises, Inc., (G5) was created. We also agreed that each project would be structured as a newly created limited liability company (LLC), (equivalent to Bare Trustee Corporation in Canada) with G5 Enterprises, Inc. serving as the Manager of each new LLC.

Since we anticipated that the bulk of the investment capital would come from a cadre of investors, we agreed that each LLC would be based on the classic “safety first” formula, where the cash investors would receive all of their capital and all of their profit before G5, as Manager, would receive any compensation.

For our purposes, we defined the following basic roles, or functions, for a real estate investment and referred to them as “Leadership Roles.”

1. The Finder

The person who located the property and presents the opportunity to the group and then oversees the acquisition through the close of the purchase.

1. The Finder

The person who located the property and presents the opportunity to the group and then oversees the acquisition through the close of the purchase.

2. The Funder

The person who contributes capital to the project, or who brings in other investor’s cash to fund the required capital.

2. The Funder

The person who contributes capital to the project, or who brings in other investor’s cash to fund the required capital.

3. The Co-ordinator

The person who manages the day-to-day details of the investment and sees the idea through to completion and serves as the primary contact person for all project activity once the project is underway.

3. The Co-ordinator

The person who manages the day-to-day details of the investment and sees the idea through to completion and serves as the primary contact person for all project activity once the project is underway.

4. The Administrator

The behind-the-scene person who is responsible for the ongoing administrative work, written reports to investors and the bank, bookkeeping and tax preparation functions.

4. The Administrator

The behind-the-scene person who is responsible for the ongoing administrative work, written reports to investors and the bank, bookkeeping and tax preparation functions.

5. The Loan Guarantor

The person or persons with sufficient financial strength who put their financial statement at risk to guaranty any loans that require a personal guaranty.

5. The Loan Guarantor

The person or persons with sufficient financial strength who put their financial statement at risk to guaranty any loans that require a personal guaranty.

In any given project, one person may play more than one Leadership Role. Likewise, any given Leadership Role may involve more than one partner. There may be occasions where not all roles are required for a project. For example, a loan guarantor would not be required if a project involves a non-recourse loan, or in a cash transaction where there is no loan.

Basic to the G5 partnership concept is the fact that each project is a separate entity that will likely have different investors providing the equity capital. The equity investors receive an attractive rate of return and are paid in full before G5 shares in the profit. Once the investors are paid their fixed rate-of-return and their 100% return of capital, the cash investors no longer participate in profits.

Having a separate entity for each project offers flexibility for each of the following of partnership elements: 1) a varying cadre of cash investors; 2) the ability to design the cash investors fixed rate of return based on market conditions and the risk and/or complexity of the project; 3) assigning different Leadership Roles among the partners based on the partners’ skill sets and time availability; 4) the option to assign a different share of the profits for each Leadership Role; and 5) the ability to adapt to the fact that the some partners may leave and/or new partners may be added.

Based on our discussions, G5 came up with the following formulas for rewarding the five Leadership Role players for our first project. Each of the following references to “profit” is based on the profit remaining after the investors have been paid their fixed rate of return and 100% of their invested capital. We refer to the profit remaining after the cash investors have been paid in full as the “G5” Profit”. Not all of the following fees are based on a percentage of G5 Profits, but all fees listed below are paid only after the cash investors are paid in full.

Of special note, selecting the appropriate percentage for each Leadership Role is a learning process. As G5 worked through subsequent projects, the partners discussed the merits of the profit-sharing percentages for most recently completed project and agreed to adjust the percentages for the five Leadership Roles for the next project. With each project, we realized that the Leadership Roles were entitled to increasingly higher percentages of the total G5 Profit, and, over time, the amounts that were left to be divided equally all partners became smaller. However, for each project, once a decision was made at the start of each project, the profit-sharing arrangement was memorialized and remained unchanged for that project. On payday, often years later, the signed Profit-Sharing Agreement for each project was used by the administrator to prepare checks to the partners.

Activating this concept has proven very satisfactory. The rewards for the partners in the special roles were very significant and the pro rata share of the Shared Profit was substantial.

The G5 distribution method based on the first rewarding a person’s contribution to a specific project works exceedingly well. This is evidenced by the fact that all five partners were fully engaged in concerted efforts to be role players in each of the new projects.