It is our observation that there are abundant stagnant Exclusive, MLS and Off Market property listings (“Equity”) housing many potential transaction opportunities.

Why this reality? First of all, many owners reason that probably the potential transaction is to a Buyer that has cash or can bring financing.

The reality is that there are many more potential transactions when thinking “Outside the Box” , than there ever will be only looking for only cash buyers.

To that end, we suggest you visit the EQUITY FUNDAMENTALS Section of this web site. Here you will be challenged to think “Outside the Box”

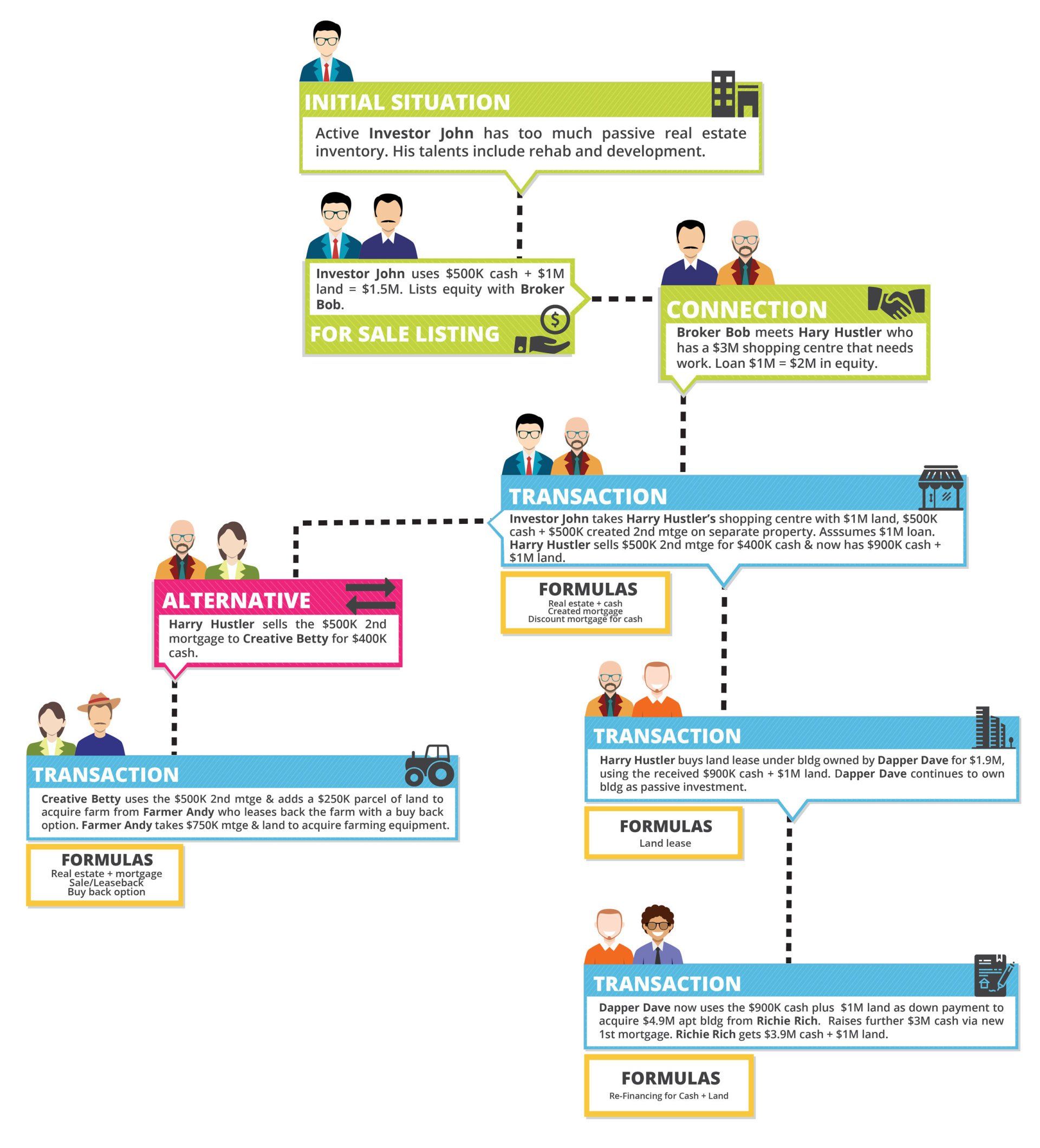

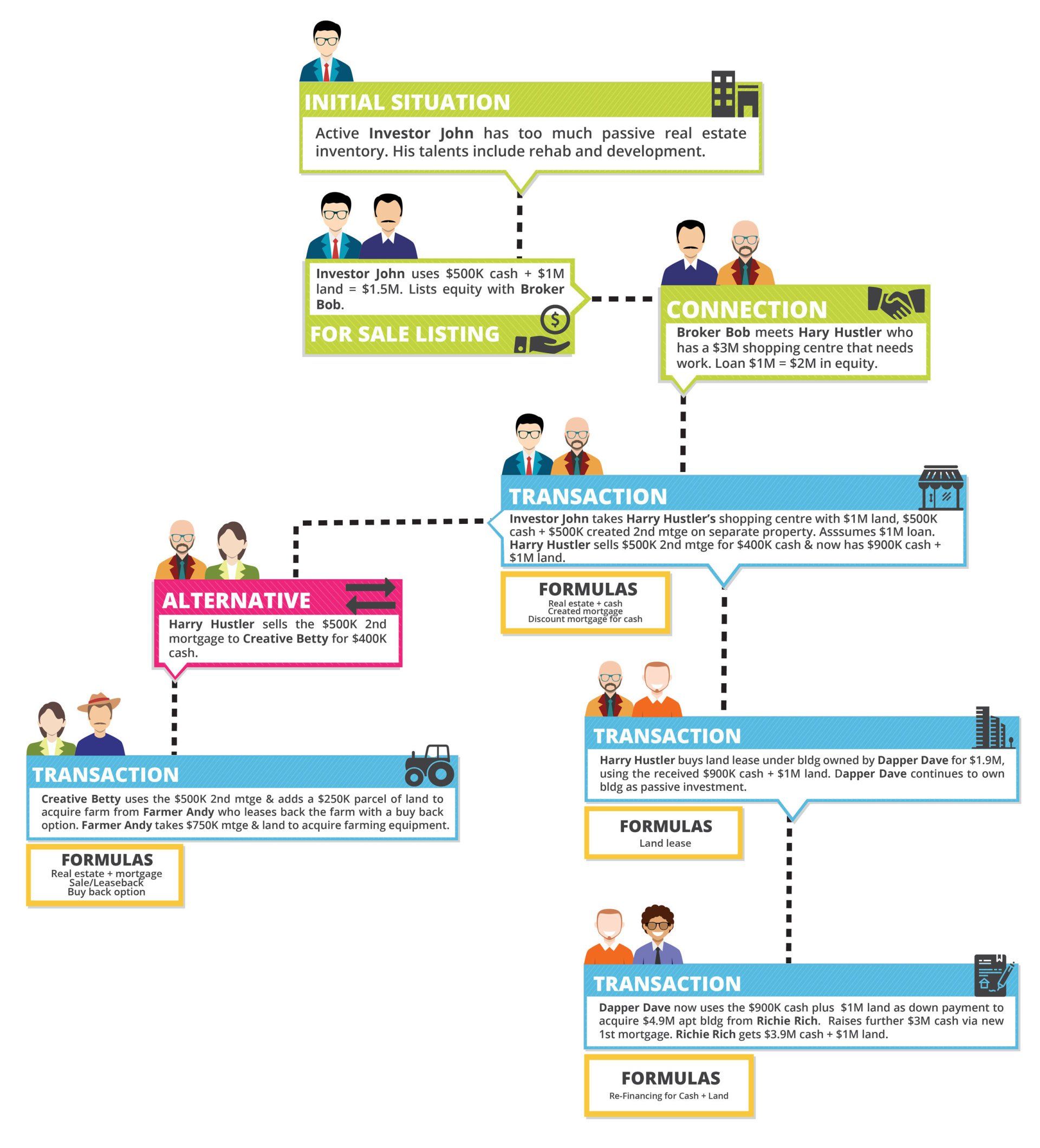

Examples of Creative Transactions:

#1: Seller has free and clear office building that is 60% occupied.

With current vacancy, conventional financing is unavailable. However, Buyer owns a free and clear commercial site that is in the ‘Path of Progress”, but not quite ready for development.

SOLUTION: Buyer creates a 40% LTV down payment mortgage against the commercial lot to give to Seller and the Seller carries back 60% LTV financing on the office building. Transaction closes with Buyer activating dead equity while waiting for a land buyer. Seller gets out of management and has a permanent income stream. Seller gets his down payment in cash when the land actually sells.

#2: Seller has a 103-room motel that had excellent cash flow but requires major remodel and upgrade to keep franchise. Seller currently had other priorities and didn’t want to finance this large rehab.

Cash Buyer prospects are few and initial prospects want to severely discount the property due to the necessary rehab.

A motel contractor is found that wishes to do the rehab, but does not have the ability to put cash in for down payment or secure the final larger loan needed.

Seller and Motel contractor locate a third-party investor that likes hotels. Third party Investor owns some free and clear condos in another jurisdiction and is willing to let them be used for the down payment plus qualify for the loan.

Transaction successfully closes because all parties achieved the benefits they were seeking. Motel Seller sold the condos a few months later.

Summary: After studying further the “CREATIVE SOLUTION FUNDAMENTALS” Section herein, you can create win-win solutions with your equities that will be fun and profitable for all.

Review everything you know about your Equity(s) and the corresponding “benefits” for a new owner.

The above are only a few of the questions needing honest internal answers to create successful transactions.

REAL ESTATE NEVER IS THE PROBLEM. IT IS ALWAYS OWNERSHIP THAT HAS SITUATIONS TO DEAL WITH.