We had an excellent quality large asset offered for sale. Owned by a successful non-profit, it had everything for the discriminating Buyer. Excellent dining facilities, beautiful well-appointed motel rooms, cabins, a land lease section with privately owned homes/cottages etc. etc. All located on a beautiful long beach etc. “Pride of Ownership” was written all over it.

Besides the benefits noted, the project was owned free and clear of debt and enjoyed 2 separate registry titles.It was determined that the Seller/Client had, in fact, the tools and motivation to think “Outside the Box” and be a catalyst in consummating a satisfactory transaction to benefit all.

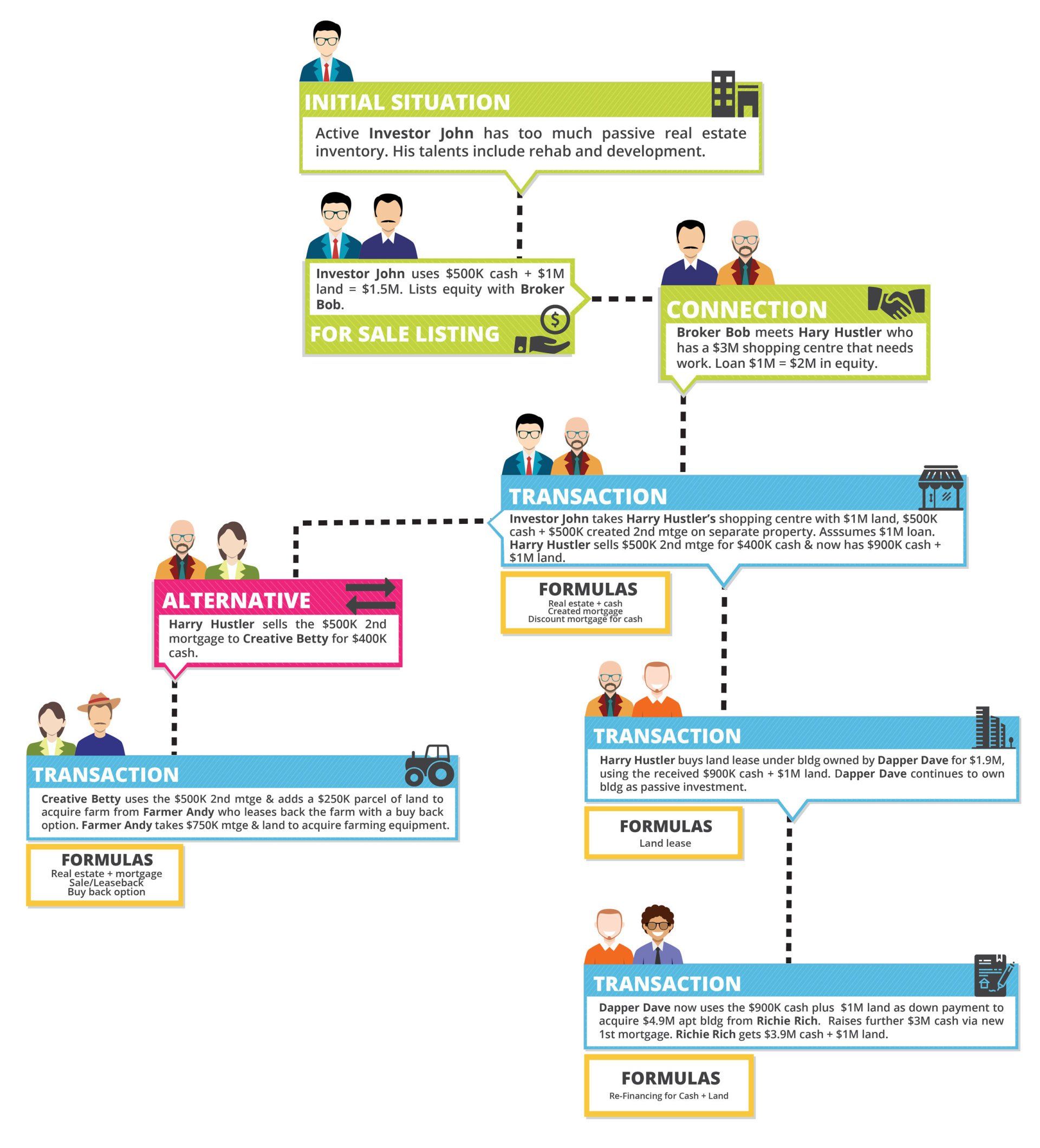

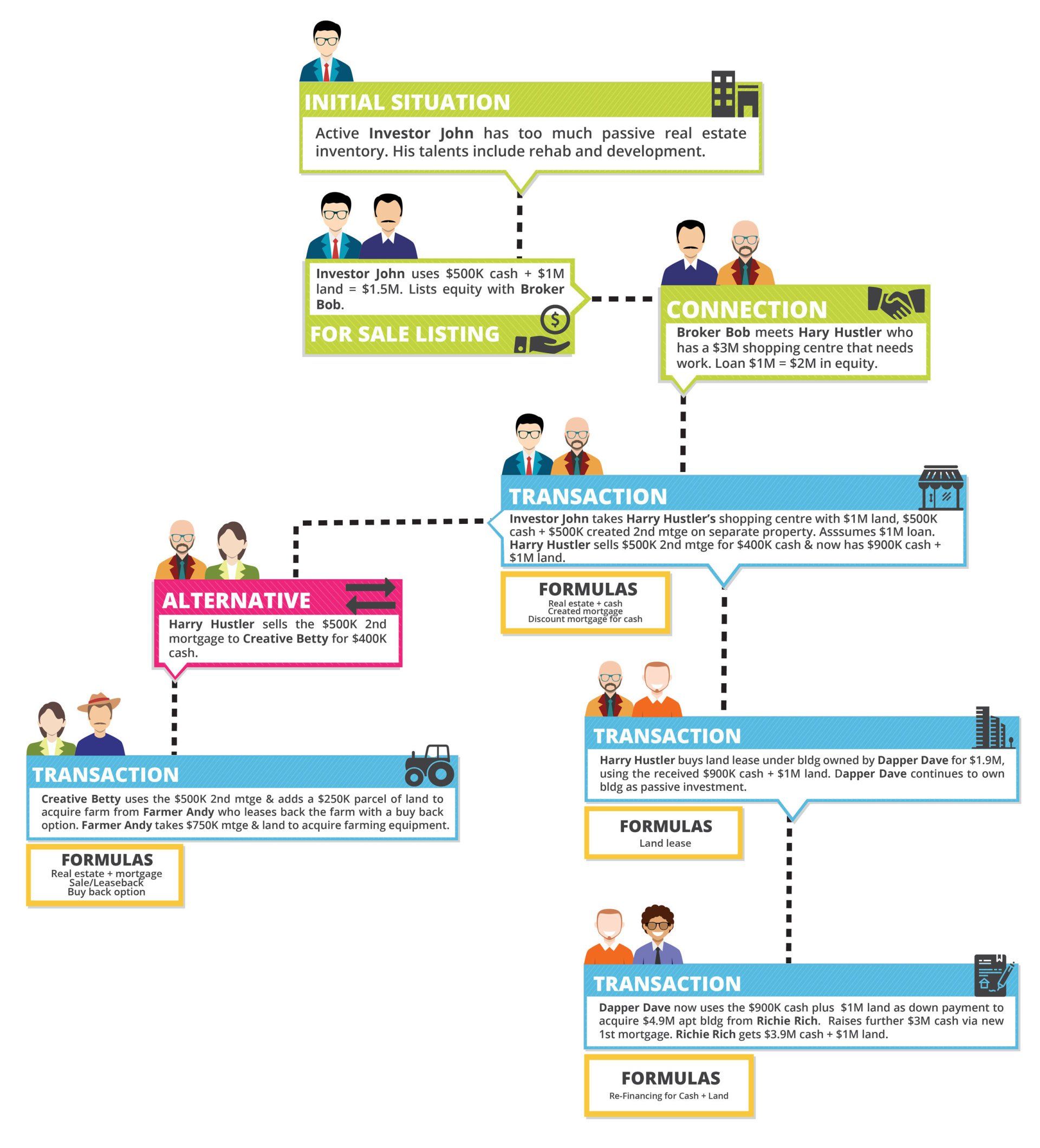

Enter the ultimate Buyer. Through the “Meet and Greet” process, we were able to determine that:

We were able to piece together a transaction something like this

Approximately 70% Seller Take Back Mortgage;

Approximately 30% taken as an Exchange of the Buyer’s Vacant Land, with assigned ultimate Purchase Agreement.