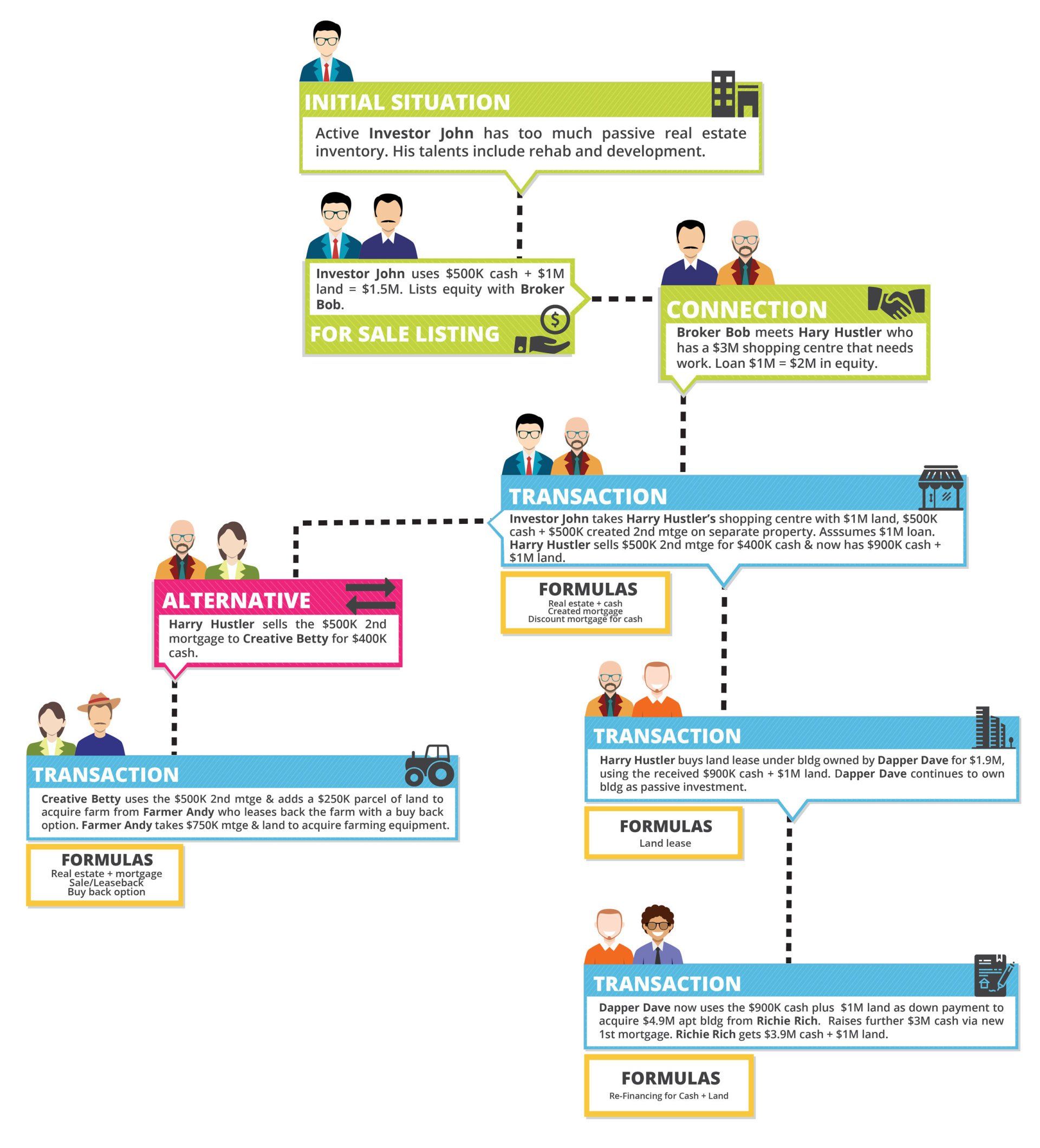

A few years ago, a partner and I owned a piece of encumbered vacant land. Through rezoning, site plan etc., it was approved for a residential subdivision. We sold the land to a developer and took back a Mortgage.

This Mortgage became the down payment for an apartment building.

We moved the equity through the apartment building to a Net Leased Government Building and Mobile Home Park. (“MHP”).

The MHP had 67 pads, which were all rented. But 10 of the homes came with the purchase. We did “Lease to Own” agreements with the renters of the 10 homes. We then rezoned the excess lands to allow for a total of 170 pads. We sold this to a group who developed the excess lands.

The increased equity was then moved from the revalued MHP and re-invested in a new geographical jurisdiction.

It’s a good story and true. However, it did not just happen. Certain initial fundamentals needed to be in play from all parties to these various transactions.

1. It involves carrying out an initial internal strategic due diligence plan of determining certain crucial aspects of future personal and/or corporate plans. In the EQUITY FUNDAMENTALS section of this website there are various articles to allow a determination of goal setting objectives.

2. Once these asset classes and complimentary personal/corporate goal setting objectives have been identified, the search begins. If time and energy allow, the “HUNT” is traditionally a very interesting and educational part of the process.

3. Although some properties are exposed in traditional MLS systems, there are substantially more “off market” opportunities laying at your doorstep. Driving around your adopted geographical “farm area”, with this mindset, will expose and expand alternative ideas etc.

4. Seek out all available information about certain identified properties initially available. Besides the properties physical attributes of zoning etc., current or historical applications for redevelopment and/or rehabilitation, etc. carry out further personal research on ownership (i.e.: Corporate Search if a corporation, Google search if personal etc.); plus, Title Search to understand outstanding debt, easements, etc. on the property.

5. And Most Important. Seek out an initial “Meet and Greet” session with the beneficial ownership of target property. Over coffee, lunch etc. a “get to know you” session, with initial non-intrusive dialogue (see EQUITY FUNDAMENTALS section) will bring about an initial thought process. We must not be in a hurry to consummate a transaction unless the opportunity represents itself in the short term. We have finalized transactions up to 10 years after initial contact. The “We Don’t Sell” comment only lasts until some personal/corporate life cycle experience requires asset divestiture. Be prepared to stay in touch with the ownership for the duration. A transaction with some entity always, in the end, finally happens. Always remember: PEOPLE DO TRANSACTIONS, NOT PROPERTIES and PROPERTY NEVER HAS A PROBLEM OR CIRCUMSTANCE, OVER LIFETIMES; PEOPLE DO .

6. If there is not an appetite to converse directly with the other side or sides, search out a qualified Broker, who understands the required fundamentals of Buyer Agency and Counselling. His or Her expertise will, on your behalf, do the required research, “Meet and Greets” etc. whether through MLS, Exclusive, or Off Market opportunities. To that end, be totally prepared to pay his or her fee. The cheapest investment you will make.