It is not hard noticing the abundance of land parcels scattered around the landscapes of Canada and the U.S. Many of these locations may consist of farm and/or ranch land, forgotten or current non-economically viable development properties, remnant parcels, large hinterland acreage parcels, forests, old quarries, parcels with economically tired and nonfunctional buildings that haven’t sold for years etc.

It is interesting that many times, busy corporations or individuals will mention these mentally discarded lands only when they remember ownership of same, when the yearly tax bill arrives.

They also may be distinguished by old, rusted “For Sale” signs, barely hanging on their supports. A sure sign of “listing fatigue”. No takers. Just helping hold the world together.

First of all, perhaps a realistic appraisal by a reputable appraiser is probably a good start. In reality, the property may not be worth what was previously envisioned. A let down, but now a more realistic perspective.

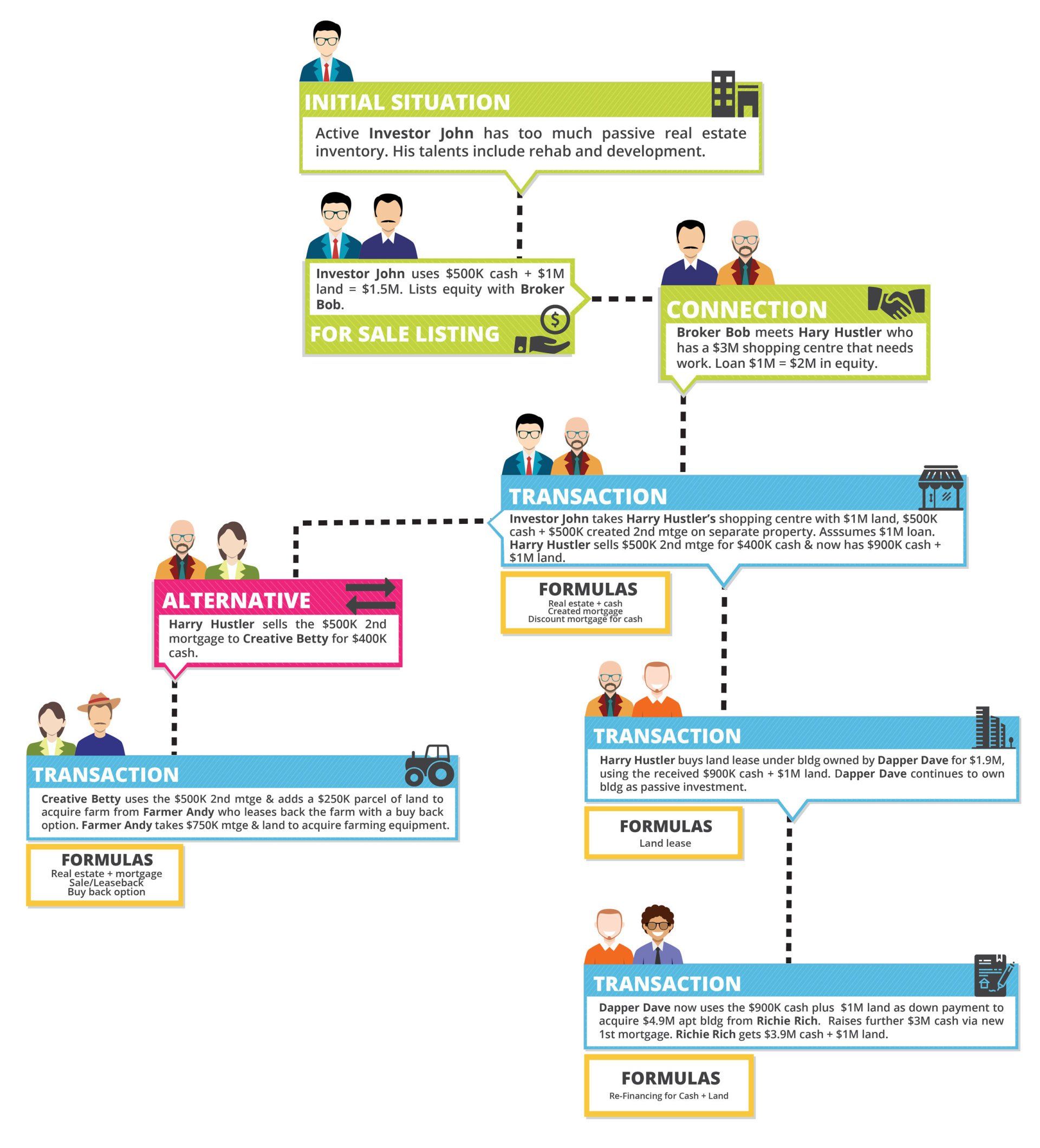

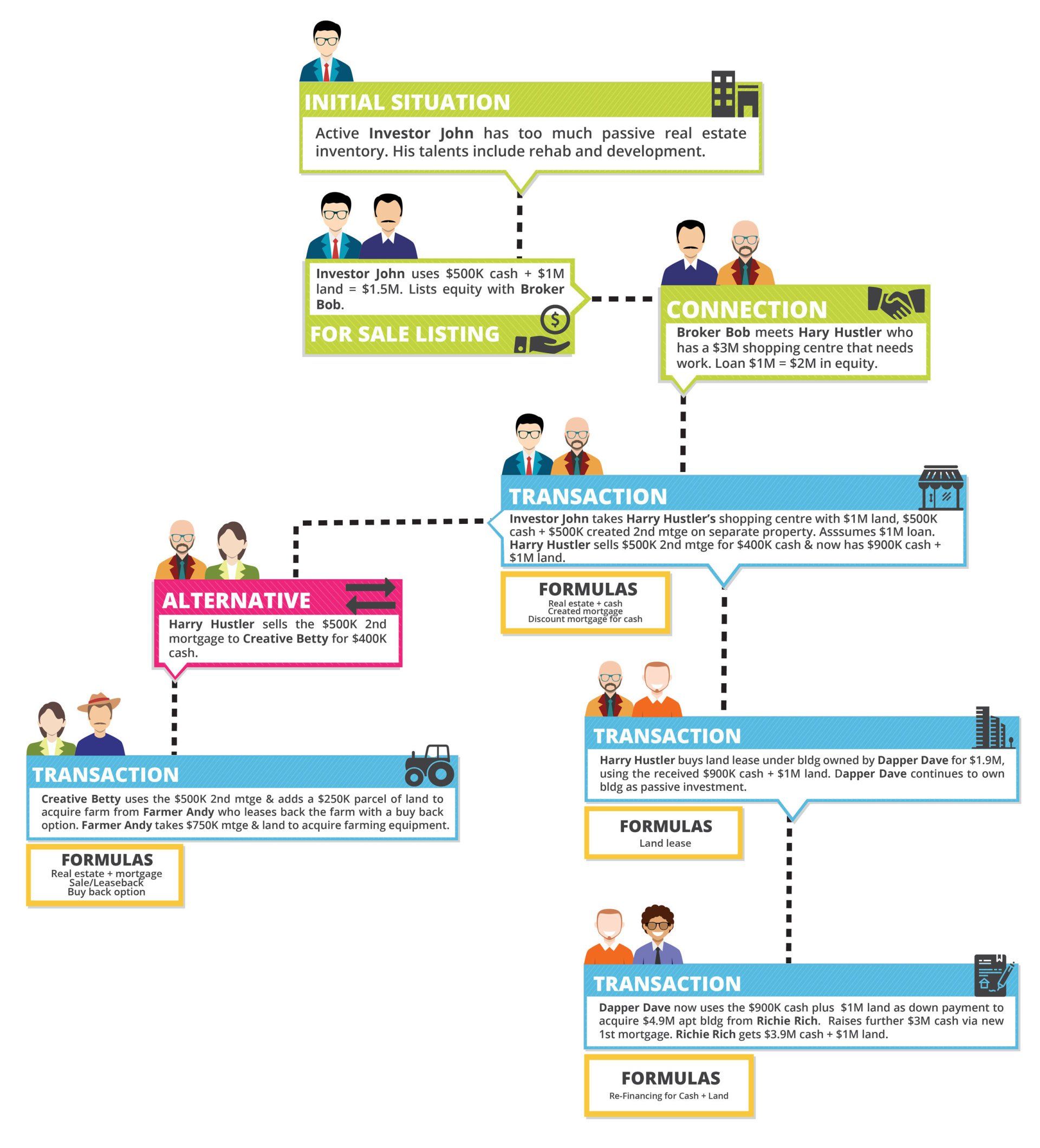

If value can be agreed upon, the next focus can be on motivation, needs, and creation of a formula to direct where the equity could be re-directed. In the EQUITY FUNDAMENTALSsection, there are various articles allowing determinations from your personal and/or corporate entity goal setting.

If financially capable, adding cash to a transaction and exchanging both your vacant land and cash for an equity in another property may be useful. Over the years, this formula has historically proven very advantageous for our clients, whether they are acquiring income properties, residential homes etc.

Another concept is to use your vacant land as an “Option Consideration” to acquire another property. This changes the landscape for the vacant land, now casting the personal and/or corporate entity as Buyers in the market. A reversal from a “sale only” mindset.

Let’s presume another equity is found that offers some sought after benefits. Use your vacant land as “Option Consideration” for the right to buy that new desired equity at some future time. For example, there may be an “Option Agreement” giving the right to acquire a certain improved building valued at, say, $1,000,000 using your $100,000 appraised “Vacant Land Parcel” as the “Option Consideration”. Upon signing the Option Agreement, the deed to your Vacant Land Parcel would transfer to the Improved Building Owner. There would be sufficient time to exercise the Option and, in most cases, receive credit at closing for the Option Consideration. If there was failure to close the Option Agreement, the Improved Building Owner would keep your Vacant land Parcel.

Why would the Improved Property Owner take the “Option Agreement”, and, more importantly, the “Option Consideration?” The Improved Property Owner may be able to use your $100,000 land to move again to another property, or use it for farming, create a land conservancy, or gift it to a charitable organization etc. In addition, the benefit of taking your land would include the anticipated $900,000 cash component.

Another variation is to not only offer your land as “Option Consideration”, but to couple that with a Lease Agreement.

What if the Option Consideration is coupled with the pledge to pay the Improved Property Owner’s real estate taxes? The Owner avoids paying taxes during the Option Period and all or a portion of the taxes paid may again be credited to the purchase. How many owners out there would love to have someone pay their taxes?

What if the Owner accepting the Option is elderly and wants to give your property to their heirs? They could give it directly to their grandchildren. There may be some gift giving tax advantages here as well, but again wise counsel is suggested.

More variations and additional options are openly available via further thought processes.

Remember. Ownership is important, but significant and often overlooked benefits of “control” of real estate can be just as valuable. Using otherwise dead or non-fashionable equities as consideration for an Option is a great opportunity. To this there are many add on complimentary formulas which can enhance the overall transaction.